Fascination About Guided Wealth Management

Fascination About Guided Wealth Management

Blog Article

The 2-Minute Rule for Guided Wealth Management

Table of Contents6 Simple Techniques For Guided Wealth ManagementAbout Guided Wealth ManagementSome Known Details About Guided Wealth Management Getting The Guided Wealth Management To WorkSome Of Guided Wealth Management

Right here are 4 things to think about and ask on your own when finding out whether you must touch the expertise of a monetary consultant. Your total assets is not your earnings, however instead a quantity that can help you recognize what money you gain, just how much you save, and where you invest money, too., while responsibilities include debt card expenses and mortgage settlements. Of training course, a favorable net well worth is far better than a negative web well worth. Looking for some direction as you're reviewing your economic scenario?

It deserves keeping in mind that you don't need to be affluent to inquire from an economic consultant. If you already have an expert, you may require to change advisors eventually in your monetary life. A major life modification or choice will cause the decision to look for and employ a financial consultant.

Your infant is on the method. Your separation is pending. You're nearing retirement (https://moz.com/community/q/user/guidedwealthm). These and various other significant life occasions might trigger the need to see with an economic advisor about your investments, your monetary objectives, and other financial issues. Let's state your mommy left you a neat sum of money in her will.

The smart Trick of Guided Wealth Management That Nobody is Discussing

In basic, a financial advisor holds a bachelor's level in an area like financing, accounting or service management. It's additionally worth nothing that you might see an expert on an one-time basis, or job with them extra routinely.

Any person can claim they're an economic expert, yet a consultant with professional designations is preferably the one you need to work with. In 2021, an estimated 330,300 Americans functioned as personal economic advisors, according to the U.S. https://www.cheaperseeker.com/u/guidedwealthm. Bureau of Labor Data (BLS). A lot of monetary experts are freelance, the bureau says. Usually, there are 5 types of monetary consultants.

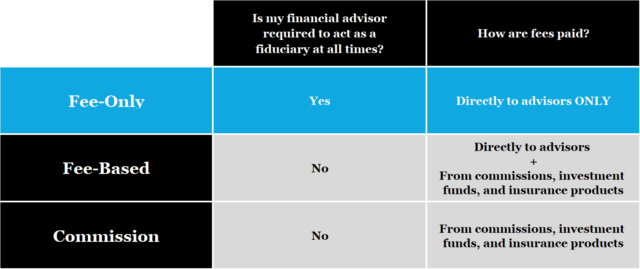

Also, unlike a signed up rep, is a fiduciary that should act in a customer's benefit. A licensed investment expert earns an advising charge for handling a customer's investments; they don't obtain sales payments. Depending on the worth of properties being managed by a registered investment consultant, either the SEC or a state safeties regulatory authority oversees them.

Examine This Report on Guided Wealth Management

In its entirety, though, financial preparation specialists aren't overseen by a single regulator. Depending on the services they offer, they might be controlled. For example, an accounting professional can be taken into consideration a financial coordinator; they're regulated by the state bookkeeping board where they exercise. An authorized investment advisoranother kind of economic planneris regulated by the SEC or a state safety and securities regulatory authority.

, along with financial investment administration. Wide range supervisors typically are registered representatives, suggesting they're controlled by the SEC, FINRA and state safeties regulatory authorities. Customers generally don't obtain any type of human-supplied financial suggestions from a robo-advisor solution.

They earn money by charging a cost for each and every trade, a level regular monthly charge or a percent charge based on the dollar quantity of assets being taken care of. Capitalists trying to find the best advisor ought to ask a variety of concerns, consisting of: An economic expert that functions with you will likely not coincide as an economic consultant who collaborates with an additional.

Guided Wealth Management Can Be Fun For Everyone

Some advisors may profit from offering unneeded items, while a fiduciary is legitimately called for to select investments with the customer's requirements in mind. Determining whether you require an economic expert involves reviewing your monetary situation, identifying which type of monetary expert you require and diving right into the history of any economic advisor you're thinking of hiring.

To complete your goals, you might need a knowledgeable expert with the appropriate licenses to help make these strategies a truth; this is where an economic advisor comes in. With each other, you and your advisor will cover lots of subjects, including the amount of money you need to conserve, the kinds of accounts you require, the kinds of insurance you need to have (consisting of long-term care, term life, special needs, etc), and estate and tax preparation.

An Unbiased View of Guided Wealth Management

At this factor, you'll additionally allow your expert understand your investment preferences. The preliminary analysis may also include an exam of other financial management subjects, such as insurance concerns and your tax obligation scenario.

Report this page